Calculating these expenses can get quite messy. To calculate COGS formula, you have to take into account all the costs involved in producing or buying the products you have sold. It is important that you get this number right so you can reduce your tax liability. It has the effect of DECREASING the amount of business taxes you have to pay. This amount reduces your business income.

#Cogs equation how to

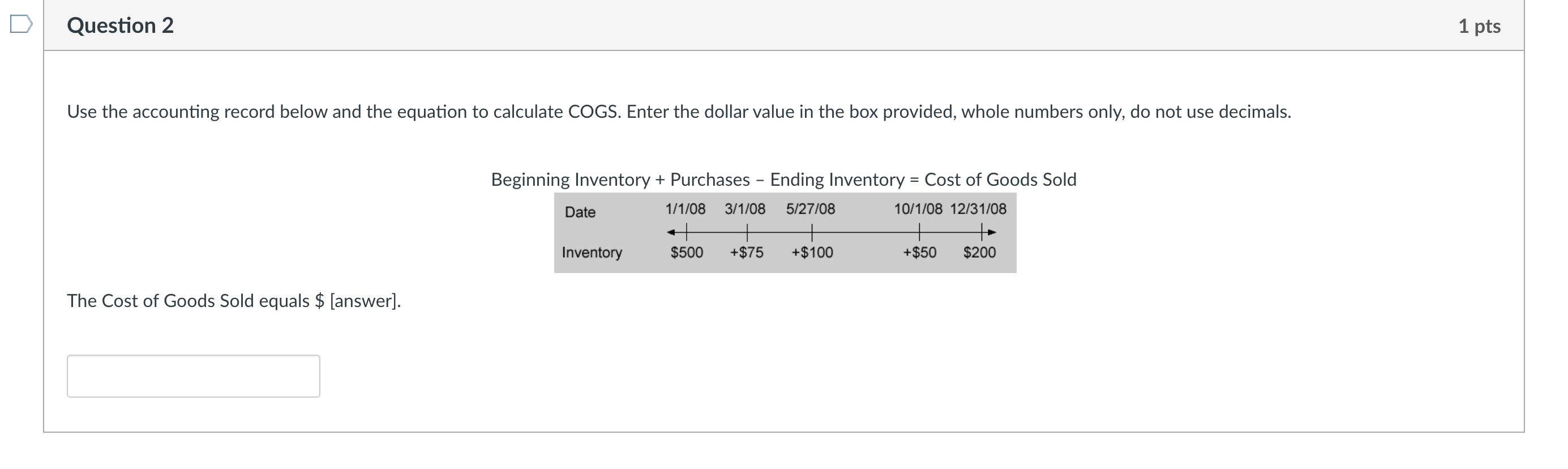

What the heck does cost of goods sold mean? This article defines what the term means, how it's calculated, and how to estimate, for tax purposes, your inventory value. When I first started selling on Amazon, I was told “cost of goods sold" is an important term to understand. You probably are feeling the same pressure as tax time gets nearer and nearer. Online businesses are not immune to this. It is that time of year when invoices, receipts, and other financial records are gathered together, so these entrepreneurs can see how much they owe the government. This is not exactly the most popular time of year for many business owners. This tells you that it's almost time to deal with terms such as Cost of Goods Sold during tax season. Same thing with settlement discount granted - regular expense - separate from gross profit calc.When the calendar switches to a new year, business owners from all over the United States breathe a collective sigh. Please help with calculating cost of sales and gross profit: Inventory (1 March 2013) - 100,000 sales - 150,000 purchases - 80,000 sales returns - 1,200 purchases returns - 2000 freight charges on purchases - 650 freight charges on sales - 1700 settlement discount granted - 350 closing inventory - 40,000 What is the cost of sales figure and gross profit? Cost of Sales = Opening Inventory + Total Purchases - Closing Inventory Total Purchases = Purchases + Carriage on purchases - Purchase returns Therefore: Cost of Sales = Opening Inventory + (Purchases + Carriage on purchases - Purchase returns) - Closing Inventory = 100,000 + (80,000 + 650 - 2000) - 40,000 = 138,650 Sales = Sales - Sales Returns (Freight on sales not included in this calculation or in the calculation of gross profit - not counted as a selling expense but just as a regular expense.

#Cogs equation full

FIFO, LIFO and Weighted Average Cost MethodsĬlick here to check out more Full Accounting Questions and AnswersĬomments for What is the Cost of Goods Sold Formula?Ĭost of Sales and Gross Profit Question by: Anonymous.Sales, Cost of Goods Sold and Gross Profit.Best, Michael Celender Founder of Accounting Basics for Students Scroll down further below for more questions and answers on the cost of goods sold formula, as well as related tutorials. The full total of purchases (which would go in the cost of goods sold formula) would thus be: Total Purchases = Purchases (purchase costs) + Carriage + Import duties - Purchases Returns See the full lesson on Sales, Cost of Goods Sold and Gross Profit for a full explanation of the cost of sales formula and gross profit.

Or to spell it out here: Cost of Goods Sold = Opening Inventories + Purchases - Closing Inventories The Purchases in the above formula actually has various sub-components, which they love to test you on in accounting tests and exams. What is the cost of goods sold formula? A: The cost of goods sold formula (also known as the cost of sales formula or equation) is:

0 kommentar(er)

0 kommentar(er)